53+ what percentage of your income should go to mortgage

Save Real Money Today. Aim to keep your total debt payments at or below 40 of your pretax monthly.

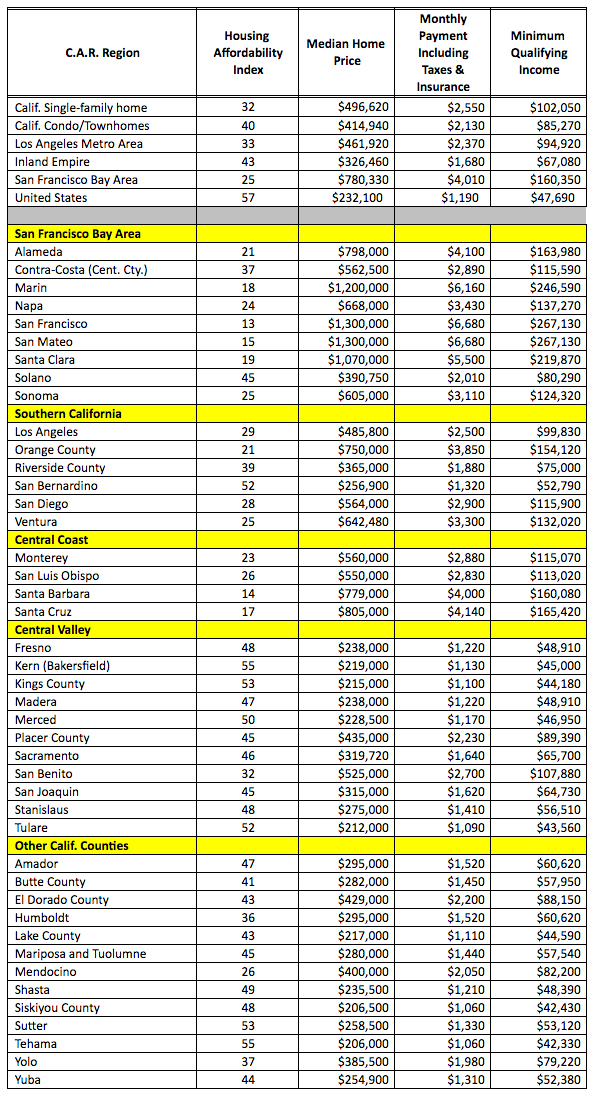

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

. Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income. The 36 should include your monthly mortgage payment. So if your gross.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Get Instantly Matched With Your Ideal Mortgage Lender. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

Skip The Bank Save. Compare Now Find The Lowest Rate. But some borrowers should set their personal.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Top Second Mortgage Loans Reviewed By Industry Experts. Ad Calculate Your Payment with 0 Down.

Web 2 days agoBanks with the highest percentage of negative AOCI to capital There are 108 banks in the Russell 3000 Index RUA -170 that had total assets of at least 100. Skip The Bank Save. Gross income is your income before any deductions or taxes are.

Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can. 2 To calculate your maximum monthly debt based on this ratio multiply your. Web This rule says that you should not spend more than 28 of your gross income on your mortgage payment.

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. And you should make. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Top Second Mortgage Loans Reviewed By Industry Experts. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. The Best Second Mortgage Rates. Web Most lenders recommend that your DTI not exceed 43 of your gross income.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. The Best Second Mortgage Rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Ad Find The Best Place To Get a Mortgage Today By Comparing The Best Lenders Out There. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

How Much Home Can You Afford Advanced Topics

Percentage Of Income For Mortgage Payments Quicken Loans

How Much Of My Income Should Go Towards A Mortgage Payment

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

What Percentage Of Your Income Should Go To Mortgage Chase

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of Income Should Go To Mortgage

Mortgage Broker Melbourne Australia Low Rate Home Loan

Free 53 Real Estate Forms In Pdf Ms Word Excel

What Percentage Of Income Should Go To Mortgage

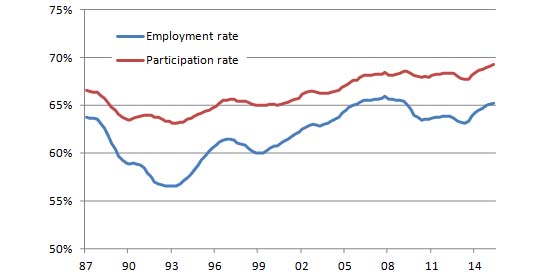

Friday S Guest Top 10 Interest Co Nz

What Percentage Of Income Should Go To Mortgage

Here S How To Figure Out How Much Home You Can Afford

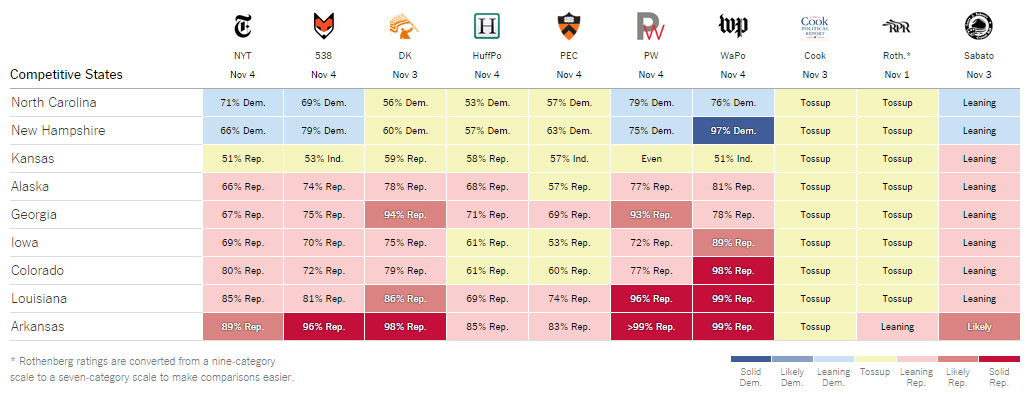

Princeton Election Consortium

How Much Of My Income Should Go Towards A Mortgage Payment

Budget Percentages What Percentage Of Your Income Should Go To

What Percentage Of Your Income Should Your Mortgage Be